If you buy a stock and want to make sure you get the next dividend payment, buy the stock before the ex-dividend date. If you own a stock and want to make sure you get the next dividend payment, don't sell the stock until the ex-dividend date or later. The ex-dividend date is important to dividend investors because of the role it plays in determining who gets the next dividend payment. Dividend investors typically use a buy-and-hold strategy in which they buy reliable stocks in solid companies and collect the dividends over a long period, buying or selling only when they want to add new stocks or dump stocks that are no longer performing. Why is it important?ĭividend investing is a system that involves buying stocks that pay a portion of the profit the company has earned on a regular basis, called dividends. In addition, the price of the ex-dividend stock will typically drop by the amount of the missed dividend so you will be buying the stock at a discount. Quick tip: When you buy a stock that has gone ex-dividend, you only lose the next dividend payment.

Instead, the payment will go to the person who sold you the stock. If you buy a stock after it has gone ex-dividend, you will own the stock but will not get the next dividend payment for that stock.

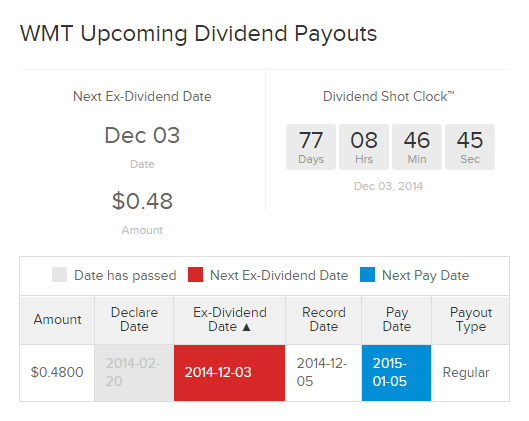

A stock is ex-dividend if it trades on or after the ex-dividend date. Ex-dividend refers to a stock that trades without the value of the next dividend payment.

0 kommentar(er)

0 kommentar(er)